The Global ESD Protection Devices Market size was USD $12.6 billion in 2023 and is projected to reach USD $19.8 billion by 2031, with a CAGR of 5.5 % during the forecast period.

Global ESD Protection Devices Market: Overview

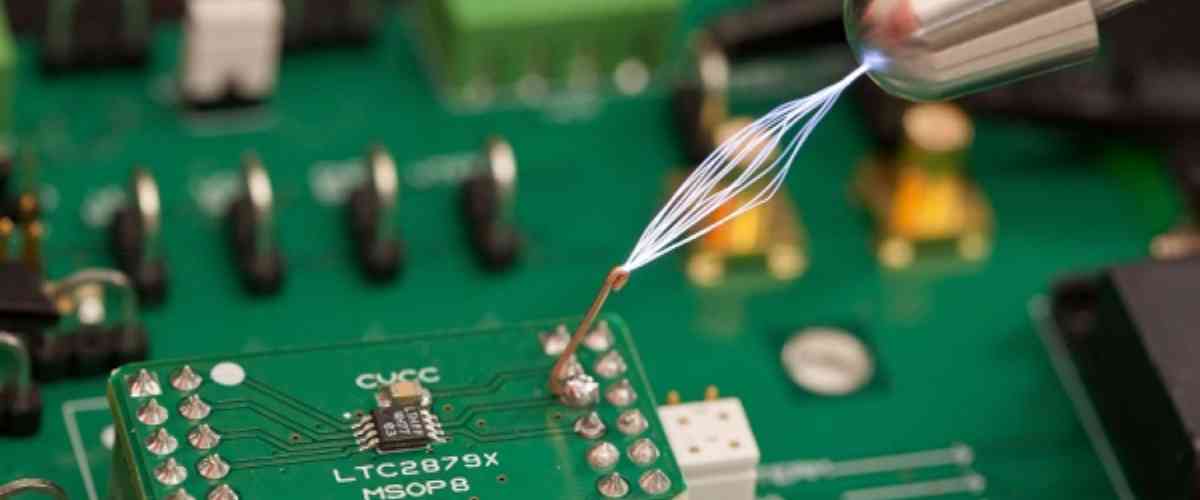

The global ESD (Electrostatic Discharge) protection devices market is experiencing significant growth, driven by technological advancements and increasing demand across various sectors. Innovations in materials, such as the integration of carbon nanotubes and graphene, are enhancing the effectiveness of ESD protection devices, particularly in high-performance semiconductor applications. Technological developments like Transient Voltage Suppressor (TVS) Diodes, which lead in revenue due to their rapid response to voltage surges, and the versatile Multilayer Varistors (MLV), anticipated to exhibit the highest growth rate, are notable trends. The rising usage of smartphones and the adoption of IoT devices are key factors driving demand, with manufacturers incorporating these devices into consumer electronics to protect sensitive components from electrostatic discharge. Regionally, the Asia-Pacific region is expected to witness the highest growth rate, supported by established players and a robust electronics manufacturing base, while North America is projected to maintain the highest revenue share due to its advanced technology landscape. However, the market faces challenges such as cost sensitivity in the consumer electronics sector, where manufacturers often prioritize cost-effectiveness over advanced ESD protection solutions, potentially hindering the adoption of sophisticated technologies. The ongoing development of ESD-sensitive components and the establishment of Protected Areas (EPAs) in manufacturing environments underscore the industry’s response to electrostatic discharge risks, emphasizing the need for effective ESD protection strategies. Overall, the ESD protection devices market is on a robust growth path, propelled by technological advancements, increased electronic device usage, and strategic innovations in materials and design.

Global ESD Protection Devices Market: Dynamics

Growth Drivers:

1. Increasing Demand for Consumer Electronics

The rapid growth in the consumer electronics sector is a primary driver for the ESD protection devices market. With the proliferation of smartphones, laptops, wearables, and other smart devices, there is a heightened need to safeguard these gadgets from electrostatic discharge. ESD protection devices play a crucial role in ensuring the longevity and reliability of sensitive electronic components, which are susceptible to damage from static electricity. The continuous innovation and production of advanced electronic products bolster the demand for efficient ESD protection solutions, thereby fueling market growth.

2. Rising Adoption of IoT and Connected Devices

The Internet of Things (IoT) has revolutionized various industries, leading to the integration of connected devices in homes, industries, and cities. As IoT devices become more prevalent, the risk of electrostatic discharge increases, necessitating robust ESD protection. These devices, often interconnected and reliant on sensitive electronic components, require comprehensive protection to maintain functionality and avoid costly damages. The expanding IoT ecosystem, encompassing smart homes, industrial automation, and smart cities, drives the demand for ESD protection devices, ensuring seamless and safe operation of these interconnected systems.

3. Stringent Regulatory Standards and Compliance

Governments and regulatory bodies worldwide have implemented stringent standards and guidelines for electronic device safety to mitigate the risks associated with ESD. Compliance with these regulations is mandatory for manufacturers, pushing them to integrate effective ESD protection solutions into their products. Adherence to standards such as IEC 61340-5-1 and ANSI/ESD S20.20 ensures the protection of electronic components during manufacturing, handling, and usage. The enforcement of these regulations not only enhances product reliability but also propels the growth of the ESD protection devices market as companies strive to meet compliance requirements.

Restraining Factors:

1. High costs associated with advanced ESD protection solutions

One of the significant restraints in the ESD protection devices market is the high cost of advanced ESD protection solutions. Implementing state-of-the-art ESD protection devices, particularly in high-volume manufacturing, can be expensive. This includes the costs associated with R&D, manufacturing, and compliance with stringent regulatory standards. Small and medium-sized enterprises (SMEs) may find it challenging to invest in these advanced solutions, potentially hindering their adoption. The cost factor can also affect the overall pricing of end products, making them less competitive in price-sensitive markets.

Opportunity Factors:

1. Emerging markets and technological advancements

Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the ESD protection devices market. These regions are witnessing rapid industrialization, urbanization, and an increase in disposable incomes, leading to a surge in demand for consumer electronics and smart devices. Additionally, advancements in technology, such as the development of miniaturized and highly efficient ESD protection devices, open new avenues for market expansion. Innovations in materials and design can lead to more cost-effective and versatile ESD solutions, catering to a broader range of applications and driving market growth.

2. Growth in the automotive and industrial sectors

The automotive and industrial sectors are increasingly adopting advanced electronic systems, which require effective ESD protection. The automotive industry, with its growing focus on electric vehicles (EVs) and advanced driver-assistance systems (ADAS), necessitates robust ESD protection to ensure the reliability and safety of electronic components. Similarly, the industrial sector’s shift towards automation and smart manufacturing processes involves the use of sensitive electronics that are vulnerable to ESD. The demand for ESD protection devices in these sectors provides substantial growth opportunities, as manufacturers seek to enhance the performance and durability of their electronic systems.

Challenge:

1. Keeping pace with rapid technological changes

The ESD protection devices market faces the challenge of keeping up with the rapid technological advancements in the electronics industry. As electronic devices become more sophisticated, with higher performance and smaller form factors, the requirements for ESD protection evolve. Manufacturers of ESD protection devices must continuously innovate to develop solutions that meet these changing demands. This requires significant investment in research and development, and the ability to anticipate future trends in electronics. Failing to keep pace with technological changes can result in outdated ESD protection solutions, impacting the market competitiveness of manufacturers.

Global ESD Protection Devices Market: Segmentation

By Material:

- Ceramic

- Silicon

By Technology:

- Transient Voltage Suppressor Diodes (TVS)

- Multilayer Varistors (MLV)

By Application:

- Antenna Circuit Protection

- Audio Circuit Protection

- I/O Circuit Protection

- SIM Card Protection

- SD/MMC Card Protection

- Others (Machine Elements, Floor Protection, etc.)

By End Use:

- Electronic Devices

- Medical Devices

- Communication Equipment

- Data Centres & High-performance Computing Devices

- Electric Vehicles

- Others (Industrial Robotics, Footwear & Mats, etc.)

Global ESD Protection Devices Market: Key Players

- Boston Connected Solutions, Quantum Tires

- InnovateWheel Technologies

- Bourns, Inc.

- Diodes Incorporated

- Infineon Technologies AG

- Kyocera AVX

- Littelfuse, Inc.

- Analog Devices

- Microchip Technology Inc.

- Murata Manufacturing Co., Ltd.

- Nexperia

- Omron Corporation

- Onesemi

- Rohm Semiconductor

- Semtech Corporation

- STMicroelectronics N.V.

- TDK Corporation

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

![[Source-artfertilityclinics.com]](https://insidermarketresearch.com/wp-content/uploads/2024/10/4-Global-Addiction-Treatment-Market-Press-Release-Source-artfertilityclinics.com_.jpg)