Financial Technology, commonly known as FinTech, has emerged as a transformative force in the global financial landscape. By leveraging cutting-edge technology, financial technology companies are redefining how financial services are delivered, making them more accessible, efficient, and user-friendly. This article explores the origins, key sectors, benefits, challenges, and future trends of FinTech, highlighting its profound impact on the financial industry.

Origins and Evolution of Financial Technology

The term financial technology encompasses a broad range of financial services that use technology to improve or innovate financial activities. While financial technology has existed in various forms for decades, the term “FinTech” gained prominence in the early 21st century with the rise of the internet and mobile technology.

The evolution of financial technology can be traced through several key phases:

Early Innovations: The 1950s saw the introduction of credit cards, which marked a significant shift in consumer finance. The 1960s and 70s brought automated teller machines (ATMs) and electronic stock trading, further integrating technology into financial services.

Internet Banking: The advent of the internet in the 1990s revolutionized banking, enabling online banking services and electronic payments. This period also saw the rise of e-commerce, which necessitated secure online payment systems.

Mobile Revolution: The proliferation of smartphones in the late 2000s and 2010s led to mobile banking and payment apps, making financial services more accessible and convenient. Companies like PayPal, Venmo, and Square became household names during this period.

Blockchain and Cryptocurrencies: The introduction of Bitcoin in 2009 and the subsequent development of blockchain technology opened new avenues for decentralised finance (DeFi) and digital currencies. This innovation challenged traditional banking systems and introduced concepts like smart contracts and peer-to-peer transactions.

Key Sectors within FinTech

Financial technology encompasses a diverse range of sectors, each addressing different aspects of financial services. Some of the key sectors include:

Payments and Transfers: This sector focuses on making transactions faster, cheaper, and more secure. Digital wallets, peer-to-peer payment platforms, and cross-border transfer services fall under this category.

Lending and Credit: Financial technology has transformed the lending industry by offering alternative lending platforms, such as peer-to-peer lending and crowdfunding. These platforms provide easier access to credit for individuals and small businesses.

Personal Finance and Wealth Management: Robo-advisors, budgeting apps, and investment platforms help individuals manage their finances, offering personalized advice and automated investment strategies.

Insurance (InsurTech): InsurTech companies use technology to enhance the insurance process, from underwriting and claims processing to personalized insurance products and risk assessment.

RegTech: Regulatory Technology (RegTech) focuses on helping financial institutions comply with regulations more efficiently through automation and data analysis.

Blockchain and Cryptocurrencies: This sector includes cryptocurrency exchanges, wallet providers, and blockchain-based solutions that enable secure, transparent transactions.

Benefits of FinTech

Financial technology offers numerous benefits that have significantly improved the financial services landscape:

Increased Accessibility: Financial technology has democratised access to financial services, especially for underserved populations. Mobile banking and digital wallets provide financial inclusion for people in remote areas without access to traditional banks.

Enhanced Efficiency: Automation and advanced analytics streamline financial processes, reducing operational costs and improving service delivery. This efficiency benefits both providers and consumers.

Better Customer Experience: Financial technology companies prioritize user experience, offering intuitive interfaces and personalized services. This customer-centric approach has raised the bar for traditional financial institutions.

Cost Savings: By eliminating intermediaries and leveraging technology, FinTech reduces transaction costs. This is particularly beneficial for international money transfers and lending.

Innovation and Competition: The rise of financial technology has spurred innovation and competition within the financial industry. Traditional banks are adopting new technologies and improving their services to stay competitive.

Challenges Facing FinTech

Despite its advantages, financial technology faces several challenges that must be addressed to ensure sustainable growth:

Regulatory Compliance: Navigating the complex and evolving regulatory landscape is a significant challenge for financial technology companies. Compliance with different regulations across jurisdictions can be burdensome and costly.

Cybersecurity Risks: As financial technology relies heavily on digital platforms, it is vulnerable to cyberattacks and data breaches. Ensuring robust cybersecurity measures is essential to protect sensitive financial information.

Customer Trust: Building and maintaining trust is crucial for financial technology companies, especially those dealing with financial assets and personal data. Transparent practices and strong security measures are key to gaining consumer confidence.

Integration with Traditional Systems: Many FinTech solutions need to integrate with existing financial infrastructure, which can be complex and time-consuming. Cooperation between financial technology companies and traditional institutions is necessary for seamless integration.

Scalability: Scaling operations while maintaining service quality and compliance can be challenging for rapidly growing financial technology startups. Balancing growth and stability requires careful planning and resource management.

Future Trends in Financial Technology

The financial technology landscape is continually evolving, with several trends shaping its future:

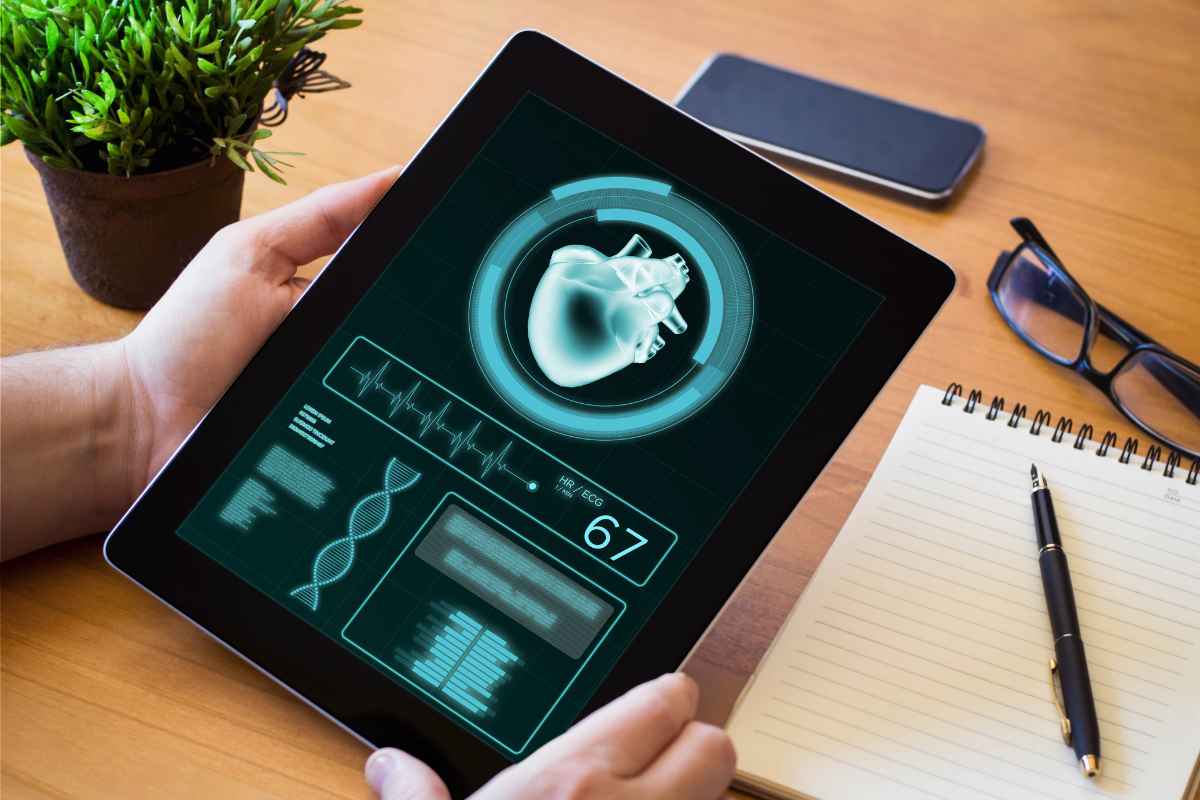

Artificial Intelligence (AI) and Machine Learning: AI and machine learning will play an increasingly important role in FinTech, from fraud detection and risk assessment to personalized financial advice and automated customer service.

Open Banking: Open banking initiatives, which require banks to share customer data with third-party providers (with consent), will drive innovation and competition. This trend promotes the development of new financial products and services.

Decentralized Finance (DeFi): DeFi platforms, built on blockchain technology, offer decentralized alternatives to traditional financial services. These platforms enable peer-to-peer lending, trading, and investing without intermediaries.

Digital Currencies and Central Bank Digital Currencies (CBDCs): The rise of cryptocurrencies and the exploration of CBDCs by central banks will reshape the monetary system. Digital currencies offer faster, cheaper, and more secure transactions.

Financial Inclusion: Financial technology will continue to focus on financial inclusion, leveraging mobile technology and innovative solutions to provide access to financial services for unbanked and underbanked populations.

Sustainable Finance: Financial technology can support sustainable finance initiatives by enabling green investments, carbon tracking, and sustainable lending practices. This trend aligns with the growing emphasis on environmental, social, and governance (ESG) criteria.

Conclusion

FinTech is revolutionizing the financial industry, offering innovative solutions that enhance accessibility, efficiency, and customer experience. As technology continues to advance, the potential for financial technology to drive further transformation is immense. However, addressing challenges such as regulatory compliance, cybersecurity, and customer trust is crucial for sustainable growth. With emerging trends like AI, open banking, DeFi, and digital currencies, the future of financial technology promises to be even more dynamic and impactful. By embracing these changes, the financial industry can continue to evolve, delivering better services and opportunities for individuals and businesses worldwide.