Source – economictimes.indiatimes.com

Visa Accused of Imposing Excessive Fees

The U.S. Department of Justice (DOJ) has filed an antitrust lawsuit against Visa, accusing the debit card giant of maintaining a monopoly that has led to billions of dollars in excessive fees for American consumers and businesses. According to the lawsuit, Visa controls more than 60% of debit card transactions in the U.S., allowing the company to charge over $7 billion annually in fees. While paid by merchants, the Department of Justice claims these fees are passed on to consumers through higher prices or lower product quality.

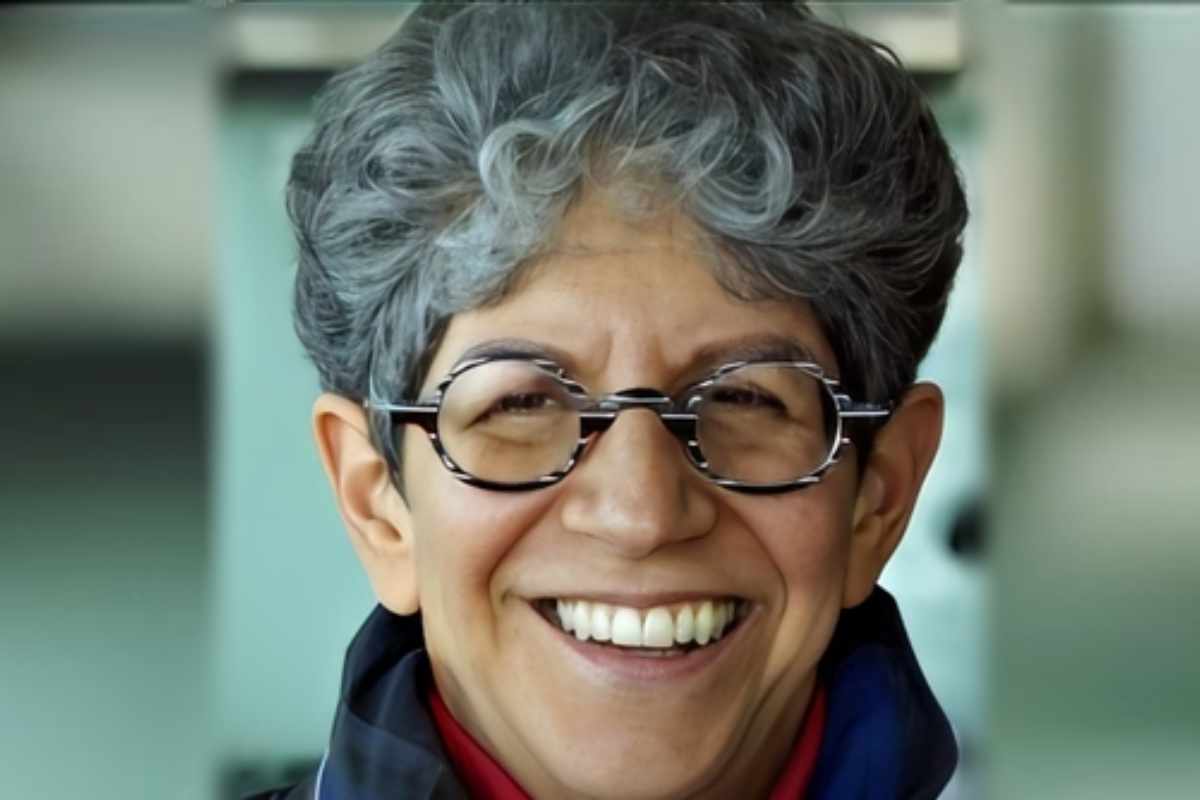

Attorney General Merrick Garland emphasized the widespread impact of Visa’s alleged actions, stating, “Visa’s unlawful conduct affects not just the price of one thing – but the price of nearly everything.” Despite the lawsuit, Visa maintains that the accusations are baseless, with Julie Rottenberg, Visa’s General Counsel, defending the company’s role in providing secure and reliable services.

Justice Department’s Broader Antitrust Efforts

This legal action against Visa is part of the Department of Justice’s broader campaign under the Biden Administration to tackle monopolistic practices. In recent months, the DOJ has pursued similar cases, including lawsuits against companies like Ticketmaster and Apple. Additionally, the department’s antitrust division won a significant case against Google last month, signaling a continued focus on addressing corporate dominance in various sectors.

In the current case, the DOJ alleges that Visa stifles competition by offering substantial financial incentives to potential competitors and enforcing exclusionary agreements with merchants and banks. According to the complaint, these agreements prevent competitors from gaining a foothold in the market and restrict alternative payment processing routes.

The lawsuit also references a 2020 DOJ case in which Visa’s attempted acquisition of fintech company Plaid was blocked. That deal was deemed harmful to market competition, with the DOJ asserting that it would have enabled Visa to maintain its monopoly and keep prices inflated. While Visa faces scrutiny, other debit card companies, like Mastercard, have also been investigated, with Mastercard settling an antitrust complaint with the Federal Trade Commission (FTC) last year.

Impact on Consumers and the Market

While the Department of Justice claims that Visa’s actions have hindered innovation and raised costs for American consumers, the immediate effects of this lawsuit may not be felt at checkout counters. According to legal experts, if the DOJ wins or settles this case, it could lead to increased competition in the debit card market, potentially driving down fees. However, any price reductions may be minimal and largely unnoticeable to individual consumers.

Douglas Ross, a law professor at the University of Washington, explained that while cumulative savings across the economy could be substantial, the impact on individual transactions would likely be small. “A penny here and a penny there over millions of transactions add up to a whole lot of money,” Ross said.

The outcome of the lawsuit will depend on Visa’s defense strategy. Rebecca Haw Allensworth, a professor at Vanderbilt Law School, noted that Visa is likely to argue that its practices benefit consumers and merchants, and the strength of these arguments could influence the case’s resolution. Regardless of the outcome, the case highlights the ongoing tension between corporate practices and consumer rights in the payment processing industry.