Swiss engineering group ABB (ABBN.S) has acknowledged the need for performance improvements after reporting mixed Q3 results for the third quarter of 2024. Morten Wierod, who took over as Chief Executive in August, addressed the company’s challenges on Thursday, emphasizing the need for a stronger focus on growth, operational efficiency, and strategic investments.

Mixed Q3 Performance

ABB, a global leader in industrial robotics and electric vehicle chargers, posted an 11% increase in its operational core profit, or EBITA, reaching $1.55 billion, slightly surpassing the forecast of $1.52 billion. However, the company’s sales, which rose by 2% to $8.15 billion, fell short of the expected $8.34 billion.

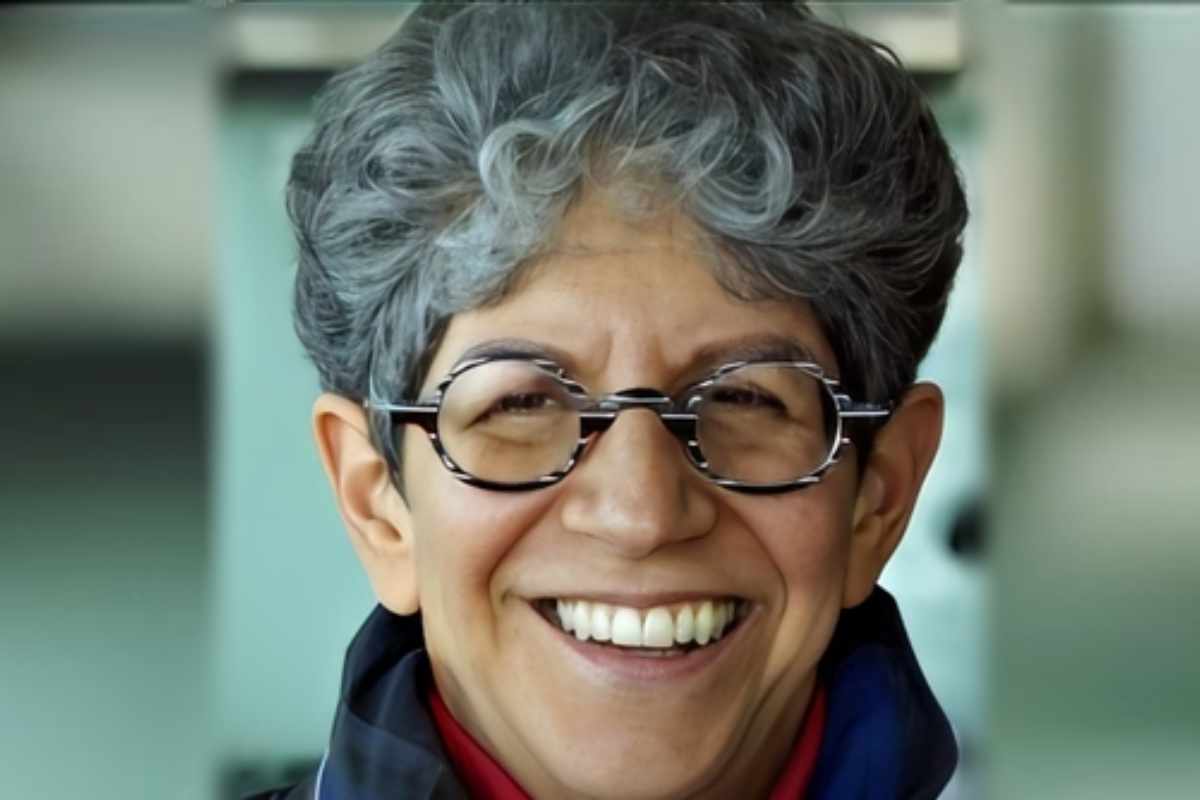

This was the first quarterly performance under Wierod’s leadership, and while profits showed a positive trend, the revenue shortfall highlighted persistent weaknesses in certain sectors. In particular, the European machine-building industry underperformed, dragging down overall sales. Wierod acknowledged that the company is not yet operating at full capacity. “In my view, ABB is not yet firing on all cylinders,” he stated, signaling areas for improvement and growth.

Strategic Investments and Focus on R&D

One of Wierod’s key priorities is to increase research and development (R&D) spending. ABB’s R&D investment currently stands at 4% of its total revenue, lagging behind competitors like Germany’s Siemens, which spends 8%. Wierod indicated that boosting R&D would be critical for supporting long-term profitability and keeping pace with technological advancements. “We are increasing our R&D and capex investments to support profitable growth,” Wierod said.

Alongside R&D, Wierod also mentioned that ABB would be focusing on mergers and acquisitions (M&A) to accelerate growth. He highlighted the need for an improved approach to M&A, signaling that the company could expect to see a higher pace of deals in the future. These acquisitions will help ABB strengthen its core businesses and expand into emerging markets, contributing to its long-term strategic goals.

Strength in Electrification Offsets Weaknesses

Despite challenges, ABB’s electrification division, which provides components and products for data centers, utilities, and infrastructure projects, continued to show strong performance during the third quarter. This growth helped offset weaker mixed Q3 results in ABB’s robotics and electric vehicle charging businesses, where sales struggled in Europe.

The company’s success in the electrification sector reflects strong demand in industries focused on infrastructure development and data management, particularly in North America and Asia. ABB’s expertise in providing critical components for these sectors is positioning the company well in regions where electrification and green energy initiatives are expanding rapidly.

Revised Full-Year Guidance

ABB adjusted its full-year guidance in light of the mixed Q3 results. The company now expects revenue growth for 2024 to be below 5%, a slight downgrade from its previous expectation of “around 5%” growth. However, ABB raised its profit outlook, forecasting that its operational EBITA margin would exceed 18%, an upgrade from the previously expected “about 18%” margin.

Despite the slight downward revision in sales forecasts, investors reacted positively to the increased profitability guidance and Wierod’s commitment to accelerating growth. ABB shares rose by 3.1% following the announcement. Analysts like Olof Larshammer from Danske Bank also saw potential in Wierod’s plans, stating that there could be room for higher growth and improved margins in the coming years.

Path Forward

Wierod’s vision for ABB involves stronger M&A activity, increased R&D investment, and greater operational efficiency to drive growth. As ABB navigates the challenges ahead, including weaknesses in Europe and the competitive landscape in robotics and electric vehicle charging, the company’s leadership is focused on positioning ABB as a more agile and innovative player in the global market.

Wierod’s strategic direction is expected to build on the company’s strengths in electrification and broaden its scope through targeted investments, enabling ABB to enhance its performance across all divisions and regions. The future looks promising as ABB continues to evolve under Wierod’s leadership, with ambitions to become a more efficient and forward-thinking industrial leader.