Source – washingtonpost.com

Gradual Slowdown in Hiring Expected

The upcoming release of the September jobs report is anticipated to mirror the gradual deceleration observed in recent months. Forecasts suggest nonfarm payrolls will show a moderate increase, with expectations of 150,000 new jobs, slightly up from the 142,000 added in August. The unemployment rate is projected to hold steady at 4.2%, according to the Dow Jones consensus. Wages are predicted to rise by 0.3% month-over-month and 3.8% year-over-year, aligning with the figures seen in August.

This stable labor market outlook has fueled optimism that the Federal Reserve can continue easing interest rates without the urgency of aggressive measures. Economists like Katie Nixon, Chief Investment Officer at Northern Trust Wealth Management, see the cooling job market as a sign that wage pressures—one of the drivers of inflation—are easing. “The balance of power has shifted back to employers and away from employees,” Nixon said, emphasizing that this trend is in line with the so-called “soft landing” many policymakers have been targeting.

However, unexpected deviations in the job numbers could still emerge. David Kelly, Chief Global Strategist at JPMorgan Asset Management, noted that while a 150,000 jobs increase is expected, a result anywhere between 50,000 and 250,000 would not be surprising. He added that the Labor Department’s frequent revisions, including a notable overcount of 800,000 jobs through March 2024, contribute to ongoing uncertainty about the true state of the labor market.

September jobs report to Be Closely Watched for Economic Clues

Scheduled for release by the Bureau of Labor Statistics at 8:30 a.m. on Friday, the September jobs report will be carefully analyzed by financial markets and policymakers alike. Investors will be searching for indicators of whether the Federal Reserve can continue to gradually lower interest rates, or if another substantial rate cut may be necessary. In September, the Fed implemented a 0.5% rate cut, and while another 50-basis-point reduction is anticipated by the end of 2024, markets are pricing in a potentially more aggressive schedule.

David Kelly from JPMorgan highlighted that the Fed is more likely to assess the broader employment landscape rather than focusing solely on the headline job numbers. “A strong report wouldn’t alter their stance, but a weak result could prompt another 50-basis-point cut,” Kelly remarked.

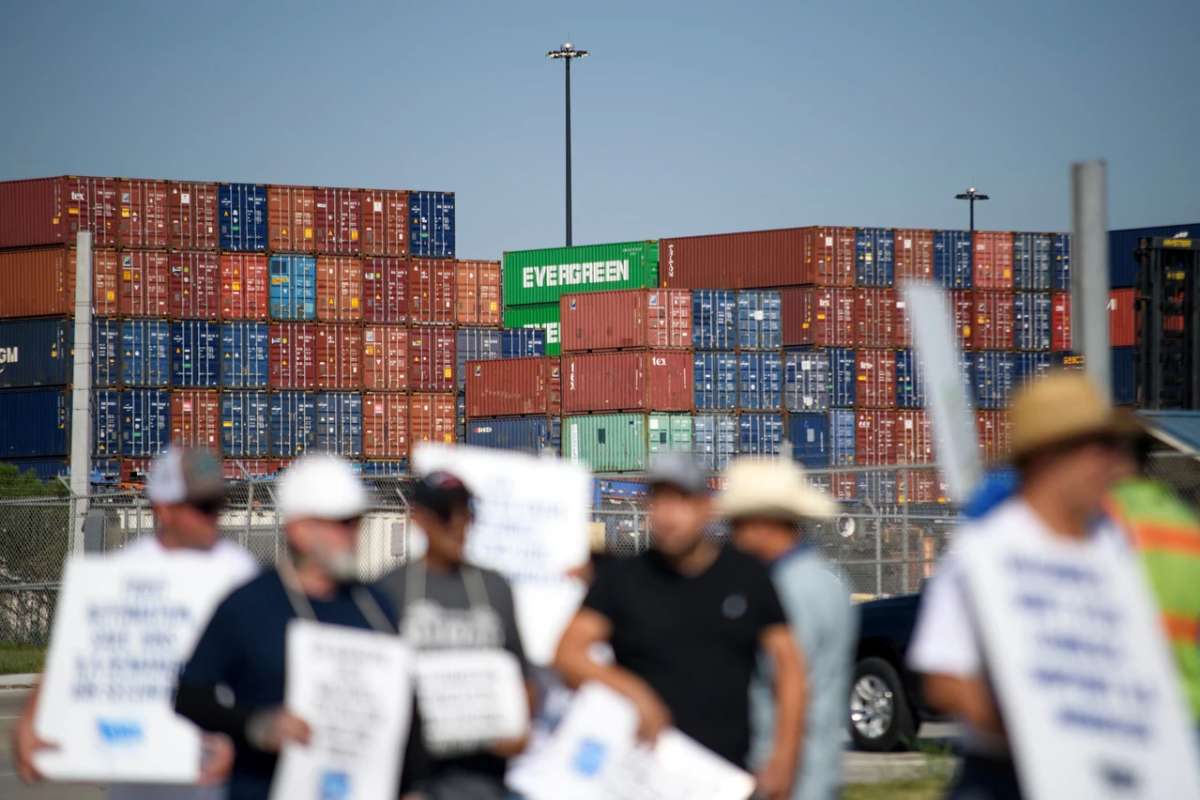

With just one more jobs report before the U.S. presidential election, the September jobs report’s data is expected to be the last “clean” reflection of the labor market before Election Day. The October report is likely to be skewed by the effects of a dock workers’ strike and Hurricane Helene, adding further complexity to the economic picture.

Labor Market Adjusts, Showing Signs of Stability

For several months, key labor market indicators have been trending downward, but not to the extent of signaling an economic crisis. Surveys from the manufacturing and services sectors point to slower hiring, while Federal Reserve Chair Jerome Powell has described the labor market as “solid but softening.” Job openings have declined, lowering the ratio of available positions to unemployed workers to 1.1 to 1, compared to the 2-to-1 ratio seen in recent years.

Despite these shifts, the labor market has reached a degree of stability after grappling with disruptions like the “Great Resignation,” during which workers left jobs in large numbers, confident of better opportunities. Joseph Brusuelas, Chief Economist at RSM, pointed out that labor’s leverage has diminished as the economy stabilizes. “We’re going to have a lot less turnover,” Brusuelas said, referencing reports from his clients about reduced employee movements within the labor market.

The current quits rate is 1.9%, the lowest since December 2014, while the separations rate, at 3.1%, has not been this low since December 2012. While the labor market may not be as dynamic as it was a few years ago, experts remain positive about the gradual but steady progress being made. Brusuelas, reflecting on the economy’s resilience, added that had he been told during the peak of the pandemic that the economy would be adding nearly 150,000 jobs a month now, he would have been highly optimistic about the recovery.

Also Read: Calculate Market Size Potential: A Comprehensive Guide